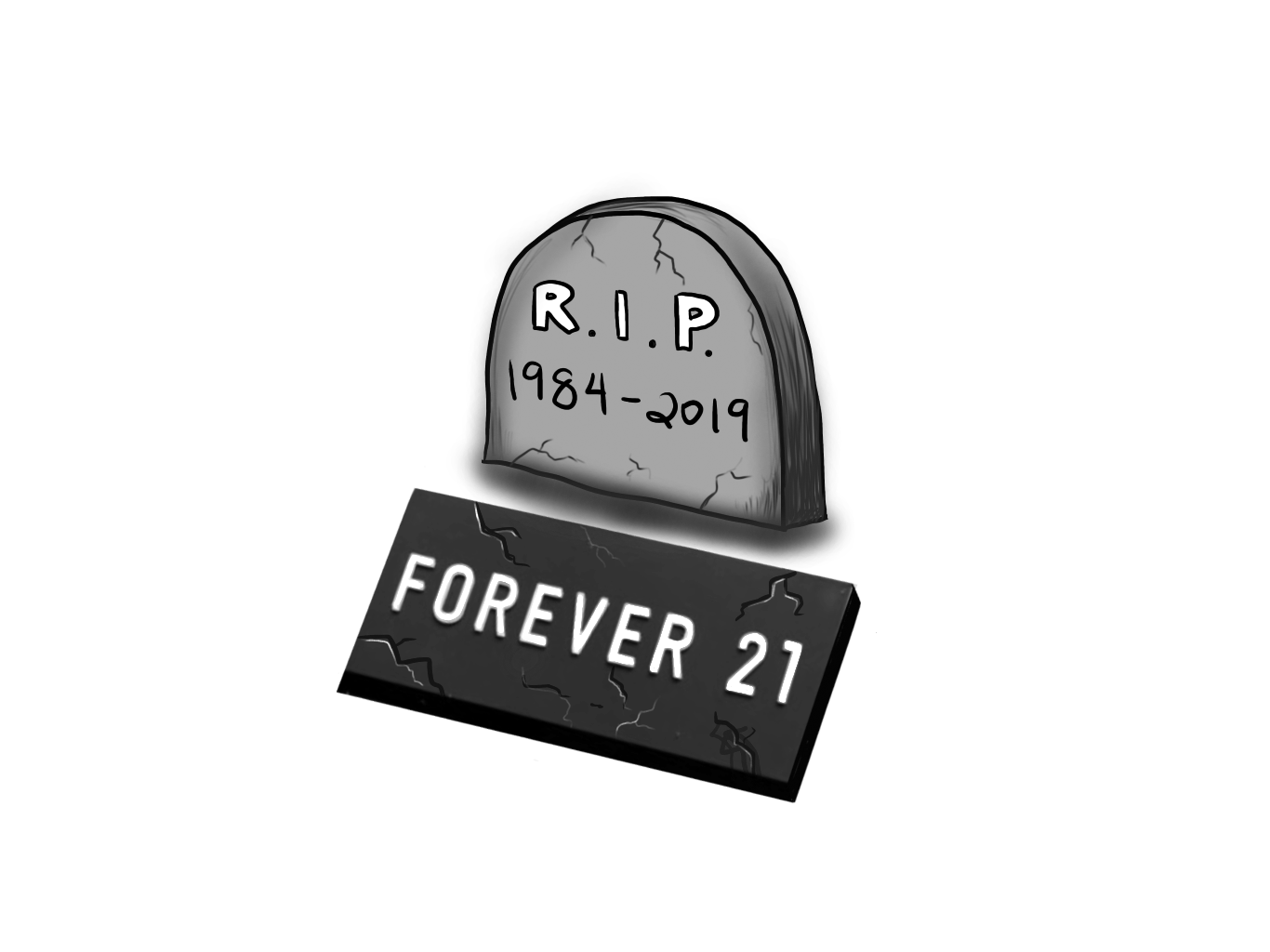

On Sept. 29, Forever 21, a popular clothing brand, filed for Chapter 11 bankruptcy protection. The chain plans to close up to 180 U.S. locations, with its online store remaining open.

Filing for Chapter 11 bankruptcy, also known as reorganization bankruptcy, is a legal tactic companies use to stay alive and repay their debts. “Reorganization means that the company isn’t doing well financially,” said economics teacher Jonathan Felder. “It may mean that they’ll disappear [from the industry] or they could just refinance.”

Just four years ago, the brand made its peak revenue of $4 billion. Since opening in 1984 in Los Angeles, the chain has expanded to over 800 locations worldwide.

Forever 21’s fall from grace is another point along the trend — in 2019 alone, fashion brands like Charlotte Russe, Gymboree and Barney’s New York have all filed for bankruptcy. Both Charlotte Russe and Barney’s New York, whose sales demographics closely resemble those of Forever 21, filed for Chapter 11 bankruptcy as well.

Meanwhile, competitors like Zara and Fashion Nova have been wildly successful, with revenue as high as $18.9 billion. This may be in part due to these brand’s primary sales coming from their online stores. E-commerce allows brands to have a wide outreach and change their inventory fast.

“The Internet has made it a lot more difficult.” Felder said. “Major Internet presences like Amazon, Walmart, etc, they can have a huge impact on companies that haven’t handled the shift [to online sales] well.”

In recent years, the brand has expanded from primarily women’s clothing lines to include children’s, men’s, and business casual lines. Originally, the brand’s allure came from its constantly changing styles and large scale production, both of which can be attributed to its use of fast fashion practices. However, this also led to a reputation of its clothes being cheap, even though its competitors who use the same practices make fivefold in annual revenue.

“They’re facing a lot of competition,” Felder said. “The space is very cyclical. Companies go in and out of fashion and it’s tough to keep up.”

Another form of competition that Forever 21 may be facing may include similar brands, or the sudden rise in popularity of another form of shopping.

After 2017, “thrifting” or shopping at local thrift stores, flea markets or other second-hand marketers burst onto the fashion scene. Teenagers are the driving force behind this trend, citing sustainability and costs as their primary reasons for choosing to thrift. Thrifting encourages purchasing long lasting, quality items, as opposed to mass produced trendy styles.

“The tastes of teenagers have shifted … maybe that’s why they’re not selling,” Felder said.

Young adults are the brand’s foundation; it’s even in the name. They hold a great deal of power in terms of determining whether a company will sink or swim. Recent years have shown a decline in foot traffic at physical locations and a slight increase in online sales.

“I think a lot of people are shopping online more,” said sophomore Natalie Graham. “It must be hard to keep physical locations open.”

If a shift away from fast fashion can’t account for Forever 21’s downfall, perhaps its public perception can. However, it may not entirely account for the company’s financial troubles.

“Companies can usually recover from bad press … it’s a lack of revenue they’re worried about,” Felder said.

“I heard a lot about [Forever 21’s] fast fashion and child labor from my friends, and a little bit online,” said freshmen Aimee Condon. “I used to shop there, but not anymore.”

Teenagers, who Forever 21 relies on for the bulk of their sales, don’t appear interested in the things they stock. This disinterest may make the store easy to overlook.

“Some of the stuff they put out isn’t what I’d buy. They put money into ideas that nobody wants.” Condon said.

After 35 years, growing from a small store in Highland Park, California to an international empire, Forever 21 will leave 180 of its 800 U.S locations behind. The changes made, may bring it back to its original title of fast fashion royalty, or allow it to fade into the background of strip mall staples.