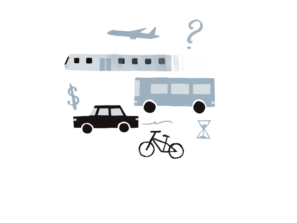

In Dec. 2020, Congress passed the Free Application for Federal Student Aid Simplification Act, which was to be implemented for the 2024-2025 school year. The FAFSA is for students seeking financial assistance to pursue higher education, and grants them a certain sum of money based on their family’s tax returns and assets. Despite intending to “simplify” the FAFSA application process by reducing the number of questions and making federal student aid more widely accessible, implementing it has proven difficult.

The FAFSA form typically rolls out around early October, but this year, families were unable to access it until Dec. 31, 2023. The Department of Education also did not send out FAFSA information to schools until mid-March. These delays have caused a significant shift in the financial aid timeline, making it so colleges aren’t able to create and send out financial aid packages to students until April, giving students a short turnaround before they must submit their Statement of Intent to Register in May.

In addition to these delays, students have struggled with technological issues while trying to submit their forms. For senior Gaby Ejercito, the form didn’t open until March.

“It was just playing the waiting game, like there was no fix to it,” Ejercito said. “Honestly, no one could help me; it was pure luck [when it worked].”

Ejercito and other seniors also encountered difficulties when it came to filling out their parents’ portion of the form.

“The part where I started having problems was when my parents had to fill out their part because they don’t have a Social Security Number,” said a senior. “So it either wouldn’t let them make an account or I had to call to verify their identity. I kept calling and calling for over a month and they would never answer. [When they did answer], they took my mom’s information and said they would send out an email, but they never did. I still haven’t gotten that email.”

Students have remarked that the main people having issues are those that have parents with no SSNs. Potential workarounds for this have been completing the form on paper and filling out the California Dream Act Application — which would only work for California public schools — as an alternative.

Financial aid advisor Caroline Moala saw many students feel discouraged with all the system glitches. Nationally, FAFSA completions are down about 40%, according to the National College Attainment Network.

“We’re the guinea pig year, [and sometimes] students want to give up because of the tech issues,” Moala said. “The process can be daunting and it can be difficult and discouraging, but we’re in this together. [Students can] attend our workshops and come see me for help. ”

[FAFSA] plays a big role [in my college decisions] because my parents aren’t able to pay all my tuition for college, even if it’s a public school

Senior Dayrin Camey’s issues with the FAFSA will impact where she decides to go to college.

“Colleges need the FAFSA to determine how much aid you’re going to get, but I missed some deadlines because of [the bugs], so I’m still trying to figure out how much they’re going to give me,” Camey said. “ [College tuitions] are pretty expensive, even in state, so if I don’t get FAFSA money for those schools, I probably won’t go.”

And Camey’s not alone. As of 2023, Aragon has 348 students that are considered socioeconomically disadvantaged, so financial aid packages are pivotal in many students’ college decisions.

“[FAFSA] plays a big role [in my college decisions] because my parents aren’t able to pay all my tuition for college, even if it’s a public school,” said senior Keven Estrada. “I committed to a private college [that has a] tuition of 72k per year, so I need them to process it quickly so I know that I’m able to pay for that school.”

Additionally, the Department of Education has removed the “sibling discount” in the FAFSA form, which increases students’ eligible financial aid if they have siblings in college.

“It’s hard for me because three of the years I’m going to be in college, my brother is also going to be in college,” said senior Dayana Munoz. “And my parents want me to go to the cheapest school possible, because they want to have money saved up for my brother too. [But that] might not be the school I want to go to so it makes my decision a lot harder because I have to consider my brother and the money aspect of it.”

Ejercito echoed this sentiment.

“I don’t think it’s fair, especially if you have a big household. I don’t want to burden my parents with the tuition they have to pay for my college and then my siblings’ colleges.”

Many issues with the FAFSA form this year may not be actionable but as of April 11, corrections have been made available.

“The good thing about FAFSA is that we can always return and make corrections,” Moala said. “The whole reason behind submitting, even if it’s blank, is to get it in by that one date.”

Moala expresses hope for a simpler FAFSA process next year.

“I’m sure once all [the tech issues] are figured out, it’ll be smoother than before,” Moala said. “[With the new FAFSA], there’s less questions for students who can possibly misunderstand and less errors.”